;

;

Mutual P&I cover

Mutual P&I is the core product offered by the West of England. It provides comprehensive protection against a wide scope of liabilities a shipowner might face and, by virtue of the Club’s membership of the International Group of P&I Clubs, unparalleled limits of cover.

Many Members also combine Mutual P&I with other products offered by the Club - typically Defence but also perhaps one of our extensive range of Extended Covers - in order to create an insurance package tailored to their particular operational needs.

The Basics

Mutual P&I Cover provides a Member with insurance against the liabilities, costs and expenses set out in the Club’s Class 1 Rules providing that they arise:

- Out of events during the period of insurance

- In respect of the Member’s interest in the vessel, and

- In connection with the operation of the vessel

Who can be covered?

The Member is usually the registered owner of the vessel but recognising that typical corporate structures may include other entities such as operators and managers who have an interest in the operation of the ship and could be exposed to potential liabilities, cover is also available to these parties on either a Joint Member or Co-Assured basis.Charterers (other than bareboat) can only be covered on a Mutual P&I policy if they are affiliated to or associated with the Member, otherwise the Club’s Charterers Cover product is available to meet their specific needs.

What we cover

Mutual P&I Cover is the Club’s principal insurance product and provides the owners and operators of vessels with comprehensive protection against a wide range of third-party liabilities which they may face, all backed by the outstanding service for which the Club is renowned. Full details of the risks insured can be found in our Class 1 Rules but they include:

- Illness, injury and death of crew, passengers and other third parties on board

- Stowaways, deserters and refugees

- Collision with other ships

- Damage to property (FFO)

- Pollution

- Wreck removal

- Loss of and damage to cargo

- Fines

- General Average (in certain circumstances)

- Salvage (certain aspects such as SCOPIC)

- Costs incurred in investigating and defending liability

- Costs incurred in inquiries and criminal proceedings

- Sue and labour expenses

Limits

As a member of the International Group of P&I Clubs, the West of England can provide unparalleled levels of cover by utilising the IG’s Pool and the extensive reinsurance which the IG Clubs collectively purchase.

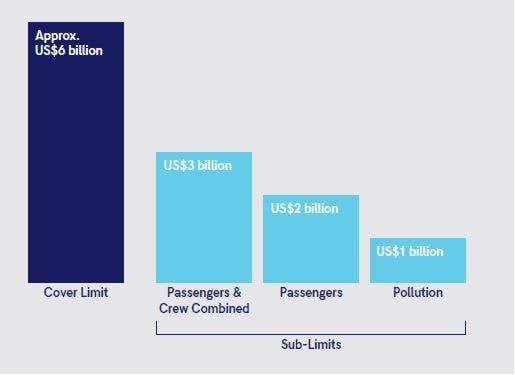

Above the level of reinsurance protection the Clubs retain the risked through “overspill” up to a maximum limit on cover based on the tonnage of all entered ships. There are sub-limits for some types of claim, as the diagram shows.

Additional Products

Although Mutual P&I cover is designed to be responsive to the third-party liabilities a shipowner might typically encounter, Members may occasionally need additional protection against risks they accept for commercial reasons but which fall outside of normal P&I cover. To support its Members the Club offers a wide variety of complimentary products to meet those liabilities which can be seamlessly tailored together with Mutual P&I Cover to provide the Member with the bespoke protection which they require. Full details can be found in our Extended Covers guide.

Why West of England?

The West of England is a leading insurance provider to the global shipping industry, combining financial strength with outstanding service to help its Members meet the continually evolving liability environment in which shipowners, operators and charterers operate.

We also safeguard and promote our Members’ interests in many other areas of their business. We believe that protection for our Members is as important as the indemnity insurance we offer. To provide both we are responsive to our Members’ needs and proactive in looking after their interests, enabling them to more easily achieve their business goals.

Our strengths

- An international Club with a global membership

- A worldwide office network providing dedicated underwriting, claims and loss prevention service to our Members

- A Member of the International

- Group of P&I Clubs