Fixed cover

To meet the needs of operators of smaller vessels, the West of England offers a tailor-made fixed premium liability insurance product offering P&I cover in accordance with Club Rules, coupled with full claims handling support.

This provides shipowners a wide scope of cover whilst maintaining the high level service capability for which the West of England is renowned, including access to a worldwide network of correspondents and experts together with the ability to offer Club letters of guarantee.

Shipowners operate in an increasingly litigious environment where liability exposure continues to become ever more burdensome. The scope and structure of our fixed premium owner’s P&I cover has therefore evolved in line with their changing needs.

Who can be insured?

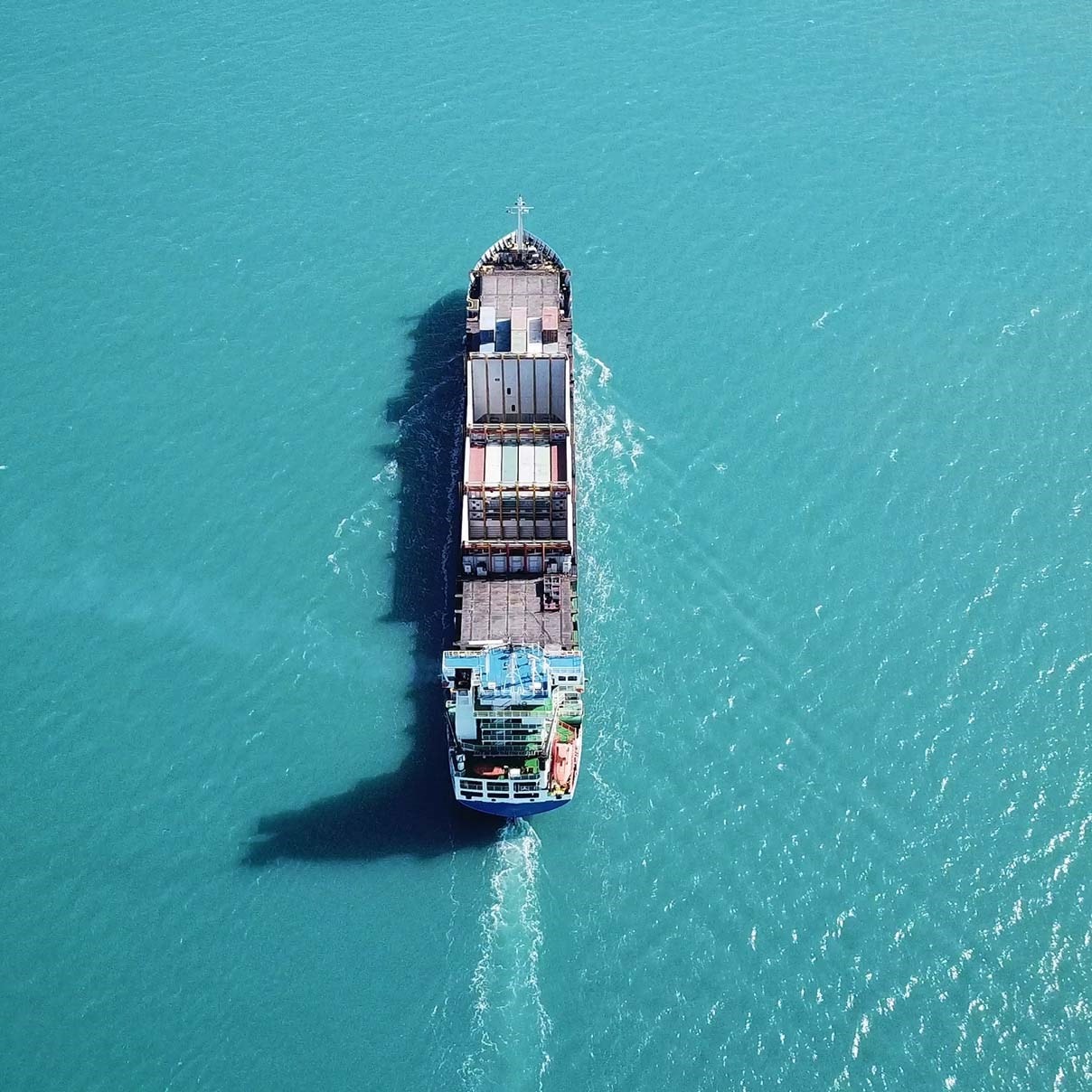

Our global product is designed for small ships and inland craft.

Types of ships which are particularly suited to our fixed cover product include:

- Tugs

- Barges

- Offshore units including OSV’s, crew and utility boats

- Dredgers

- Small bulk carriers

- Small container and general cargo ships

- Small clean and dirty tankers

- Ro-Ro

- Fishing boats

- Small passenger vessels

The product is suitable for most types of trade, whether it be liner operations, or conventional tramp market chartering.

Please note that US flagged ships are the only exclusion of this facility.

Fixed Premium P&I Cover

P&I Risks

The shipowner is insured for a variety of risks which include but are not limited to:

- Injury, illness or death of seafarers, passengers and other persons on board

- Diversion

- Life salvage

- Collision and FFO (Fixed and Floating Object) damage

- Pollution

- Customary towage

- Wreck removal

- Unrecoverable GA contributions

- Fines and civil penalties

- Confiscation of vessels

Our focus is on small craft which usually means less than 10,000 GT

- Cover placed as a single package with one policy

- Single aggregate limit per incident

- We offer variable limits up to USD 1 billion

- Ability to tailor the product to specific heads of cover which best accommodate a shipowner’s needs

We also issue:

- PLR certificates

- MLC certificates

- CLC

- Bunker Convention and

- Removal of Wreck blue cards

Our guarantees and blue cards are accepted worldwide by all flag states

Additional Benefits

Claims:

- With a permanent staff of over 150 world-wide and a network of partners and subcontractors, we provide an international service of the highest quality from an experienced and dedicated team

- Owners using this cover will have the benefit of full access to this expert team of claims handlers and global network of correspondents

- Claims handling services are provided on a 24-hour basis through any one or more of the offices in London, New York, Hong Kong, Singapore and Greece

- Our Club guarantees are accepted worldwide and can be provided at short notice and at no cost

Loss Prevention:

- Owners using this cover will also have access to our highly respected Loss Prevention department

- With a combined total of over 150 years’ experience as senior Deck and Engineering officers, including as Captains and Chief Engineers, on almost all vessel types and in a variety of shore based management positions, the department is ideally placed to offer guidance on issues that shipowners may be facing in trading their vessels

- The Loss Prevention department is a resource which our shipowners are actively encouraged to utilise, be it for technical, operational, risk management, advice or assistance

- Extensive Loss Prevention information and materials are also available on the Club’s website

Download the brochure here

-

Fixed PDF (1.1 MB)

-

Fixed (Portuguese) PDF (1.1 MB)

-

Fixed (Spanish) PDF (1.1 MB)

-

West Fixed (Chinese) PDF (1.1 MB)

Why West of England?

Our strengths

- An international Club with a global membership

- A worldwide office network providing dedicated underwriting, claims and loss prevention service to our Members

- A Member of the International Group of P&I Clubs